What is credit rating? Its role and significance.

What is credit rating? Its role and significance. This is the process of assessing the financial credibility of a company or a debt-issuing organization.

A Credit Rating refers to the evaluation of the financial capacity of an organization, business, or even a country to repay its debt obligations on time.

The main purpose is to reflect the level of credit risk for lenders or investors.

Let’s explore the roles and significance of credit ratings with SaigonRatings — one of the leading and reputable credit rating agencies in Vietnam.

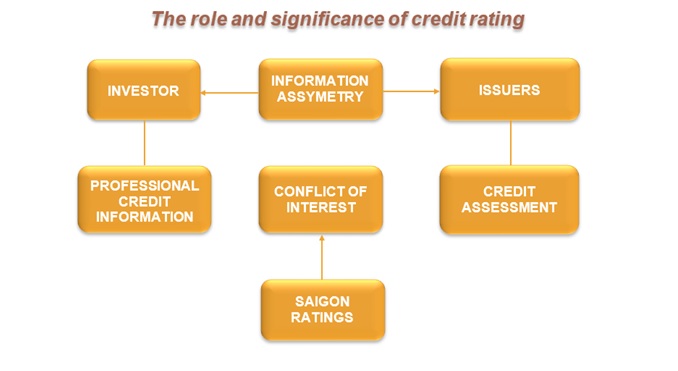

I. THE ROLE AND SIGNIFICANCE OF CREDIT RATING

- A credit rating agency (CRA) is one of the intermediaries of the international and national financial markets. CRA

performs credit ratings of issuers (financial and non-financial) and debt instruments, is an integral part of the

requirement for synchronous development of debt capital market infrastructure, to overcome information asymmetry

in financial markets; and at the same time provides objective, timely and reliable for investors (institutions and

individuals) in domestic and international financial markets. - Credit ratings information of issuers and/or debt instruments is an independent, objective and useful reference

base to help investors minimize investment risks and is a reference tool for effective asset management. - For issuers, Credit rating information will be an important basis for accessing more mobilization channels in the

capital market, contributing to reducing the cost of financing and raising capital and having more options to balance

and restructure debt instruments to meet business development goals. - Finally, the financial market also benefits from Credit Rating activities as it gradually contributes to the creation of

diversified investment demand and improves market performance by minimizing information asymmetry.

II. DEFINITION OF CREDIT RATING

Credit Rating is an assessment of the creditworthiness of ability to fully fulfill and on time the debt obligations of the

issuer and/or Debt Instrument. The credit rating is carried out by world CRA organizations, based on a

comprehensive assessment analysis and concurently relevant qualitative and quantitative significant risk factors of

the issuer.

2.1. Issuer rating (corporations or financial institutions)

- The issuer credit rating of Saigon Ratings is an objective assessment of the overall creditworthiness of that issuer.

- This assessment focuses on the issuer’s ability and willingness to meet its financial commitments when payments come

due. This, however, does not apply to any particular financial obligation, as it does not take into account the nature

and terms of the obligation, nor the recoverability of each obligation in the event of default.

2.2 Credit rating of debt instruments

- Saigon Ratings‘ debt instrument credit rating, which is an objective assessment of an obligor’s creditworthiness for a

particular financial obligation, a particular type of financial obligation, or a particular financial instrument.

Opinion reflects Saigon Ratings ‘ view of the obligor’s ability and willingness to meet its financial commitments, when

they come due. Credit rating of debt instruments, including the integration of assessment of commitment terms,

collateral and other factors (for example, credit rating of the guarantor or other forms of guarantee) other credit of the

obligation), which can affect the ability to collect the debt in the event of an issuer default. - Credit ratings on debt instruments (including bonds or loans) can be long-term or short-term. Short-term credit ratings

are usually assigned to short-term debt instruments (with maturities equal to or less than 12 months). Short-term debt

instrument credit ratings are also used to assess the creditworthiness of the obligor, for the exercise of put options

with maturities of less than one year, of long-term debt instruments.

III. TYPES OF CREDIT RATINGS

According to the professional practices and standards of the world’s independent credit rating agencies (Credit Rating

Agency – CRA), Saigon Ratings applies two types of credit ratings, solicited and non-solicited, to issuers (financial and

non-financial) in the domestic market.

3.1 Solicited credit rating

- A solicited credit rating means the rating activity performed with rating fees when Saigon Ratings signs a contract of

providing rating service with the clients. In the process of solicited rating implementation, Saigon Ratings pays special

attention to compliance with the Internal Control system regarding management policies and mechanisms for resolving

conflicts of interest to prevent, detect and promptly handle risks in the credit rating operation process. - The solicited rating may be either a public credit rating (disclosure of the rating results) or confidential credit rating (no

disclosure of the rating results), depending on the requirements of the rated entities or third parties.

In case the customer requests Saigon Ratings to keep the rating results confidential, the parties can agree on the terms

of confidentiality commitment in the Credit Rating service provision contract.

3.2 Unsolicited credit rating

- An unspecified credit rating is a rating activity performed with not rating fees when Saigon Ratings does not sign a

contract of providing rating service with the clients. In this case, the rating results are kept confidential. Unsolicited

credit rating is implemented as a part of professional operations of one CRA. - Saigon Ratings only performs the Unsolicited credit rating for specific research subjects, when we believe that there is

sufficient important information to meet the requirements of Saigon Ratings’ Rating methodology.

IV. OUTLOOK

The rating outlook provides additional information on the rated entity’s expected rating transition trend in the medium

and long term (Long term Credit rating). The time horizon of Rating Outlook is longer than Credit Watch listings, and

incorporate trends or risks that we believe may occur affecting creditworthiness.

Rating outlook is assessed by Saigon Ratings, including 04 levels: Stable, Positive, Negative, Developing.

• A “Stable” outlook indicates that the Rating is likely to remain unchanged.

• A “Positive” outlook indicates that the Rating could be raised.

• A “Negative” outlook indicates that the Rating may be downgraded.

• The “Updating” outlook indicates that the Rating may be raised or lowered.

When Saigon Ratings issues a “Positive” or “Negative” outlook rating, it does not imply that a rating must necessarily

be upgraded or downgraded in the future.

Saigon Ratings discloses the outlook of the rated entity to be the “Positive” or “Negative” when an event or trend has

less impact on the ability to change ratings than Credit Watch.

The Outlook is disclosed to be “Positive” or “Negative” when the occurrence of an event or trend may lead to a change

in rating in the medium term. For example, a company with rapid improvement in income and cash flow may still have

a “Stable” outlook if Saigon Ratings considers this as an unsustainable trend which will be less likely to upgrade its

rating.

V. CREDIT WATCH

Credit Watch highlights the potential direction of a short-term or long-term rating. The events happening to the rated

entity in Credit Watch list will be the basis to put the rating under special supervision.

Unusual events may arise from the following factors:

• Factors affecting macroeconomics.

• Effects of industry fluctuations.

• Influence from internal business activities.

Saigon Ratings uses Credit Watch when we think it is necessary to monitor the credit rating of that business within

90 days.

Ratings will be included in Credit Watch in the following cases

• Case 1: When an event that deviates from the expected trend has occurred or is likely to occur and when additional

information is needed to draw a conclusion or debt instrument.

• Case 2: When Saigon Ratings believes there has been a material change in the performance of an issuer or Debt

Instrument, but the magnitude of the effect on the Rating has not been fully reflected and Saigon Ratings believes

that Rating changes are likely to happen in the short term.

• Case 3: Changes in the evaluation criteria have been applied and require a review of all rated businesses in the

economic sector, and Saigon Ratings believes that such changes have may affect the Credit Rating results.

Typical examples:

▪ Case 1: Issuers are usually put under the rating supervision if arising events such as refinancing, or developing

unusual business activities.

• Such ratings will be completed as soon as Saigon Ratings receives the necessary information and completes the

analysis. The usual time is within 90 days, unless the review last longer than expected and are pending.

• Case 2: Business may be placed under supervision if there is a decline in performance, until Saigon Ratings has

completed its analysis of the impact on the Rating, and usually within 90 days.

• Case 3: A group of transactions or transactions of an issuer may be placed under supervision if affected by changes

in the evaluation criteria.

In cases where the Credit Watch is maintained for more than 90 days or when the event is significant or there is a

change other than the expected trend, Saigon Ratings will provide temporary updates to assess the actual current

situation of the business.

In cases where ratings are placed on Credit Watch due to a deterioration in the effectiveness of assets or due to changes

in criteria and evaluation analysis in excess of 90 days, Saigon Ratings will announce the expected time frame for

completing the assessment of situation mentioned above.

• If Credit Watch is positive, the rating may be upgraded.

• If Credit Watch is negative, the rating may be downgraded.

• If Credit Watch is developing, the rating may be upgraded, downgraded or maintained.

VI. CREDIT UPDATE

After the business is monitored or included in Credit Watch, Saigon Ratings will issue a Credit notice Update to issuers

in the following cases

• Material events occur that affect the issuer’s current Rating and there is sufficient data to review the current Rating;

or

• Rated Issuer issues additional debt instruments; or

• The issuer rated issue additional debt; or

• The current Issuer Rating is cancelled.

In the above cases, Saigon Ratings will announce that Credit Update will be “upgraded”, “degraded”, “reserved”, or

“cancelled”.

VII. DISCONTINUE RATING AND WITHDRAW CREDIT RATING

If the rated entity fails to provide appropriate, accurate and sufficient information, Saigon Ratings will lack an objective

and reliable information to maintain rating surveilliance, and must discontinue ratings of issuers or issues.

If the Rated organization does not cooperate effectively in providing the necessary, accurate, timely and complete

updates, Saigon Ratings will not have a solid and objective database, in order to be able to continue to maintain and

implement the Rating Monitoring process and operations on an annual basis.

Discontinue rating

Credit rating may not be updated continuously in the following cases:

• The enterprise has paid off the financial obligations arising from the debt;

• Most of liabilities of the issuer are transferred to another party;

• The debt obligation terminates in accordance with the terms agreed upon by the related parties; and

• Other reasons.

Withdraw rating

Saigon Ratings may unilaterally withdrraw the announced rating of corporates/ issuers/ issues in the following cases.

• At the request of the rated entity;

• The deadline for supervision and update of ratings is overdue;

• The rated entities do not provide sufficient information and do not cooperate with Saigon Ratings in rating

surveillance;

• The enterprise does not fullfill the obligation of rating service fees payments according to the agreed contract.

• The surveillance of rating is not necessary, for example, the business is going bankrupt.

The rating withdrawal will be reviewed and determined by Saigon Ratings Committee and can be performed at any time

when any of the above cases arise.

CREDIT RATING DEFINITIONS AND TERMS

If your business is seeking a credit rating to enhance financial transparency and attract investment, please contact us at www.saigonratings.com for detailed consultation.